2025 Gross Receipts Test. Aug 12, 2025 · authored by christine faris and devin tenney. Foreign corporations, controlled groups, and the gross receipts test.

The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic relief programs in. Note these steps need to be followed on a quarter.

The irs defines gross receipts as “the total amounts the organization received from all sources during its.

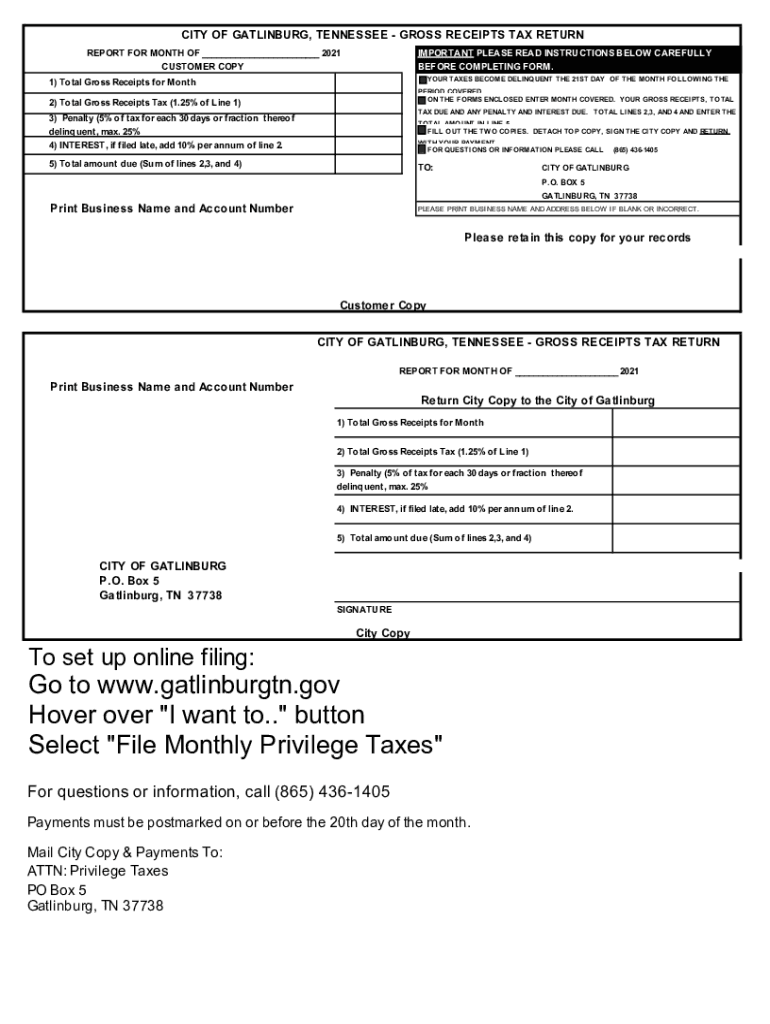

Gross Receipts 20212024 Form Fill Out and Sign Printable PDF, A corporation or partnership, other than a tax shelter, that meets the gross receipts test can generally use the cash method. The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic relief programs in determining whether it qualifies for the employee retention credit (erc) based on a decline in gross receipts (rev.

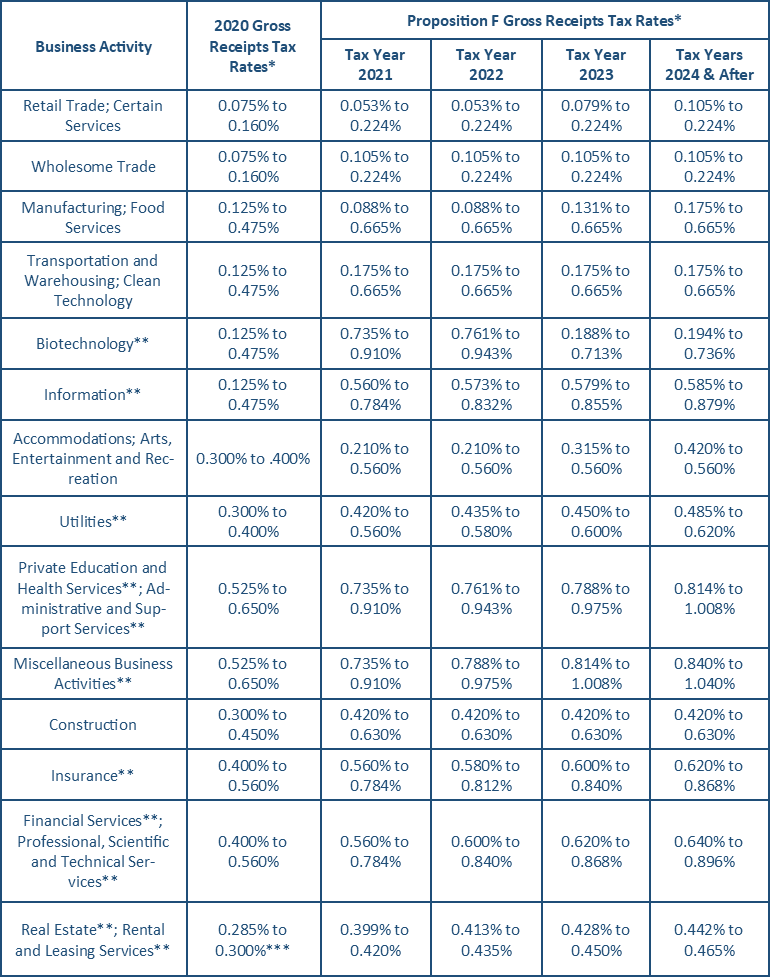

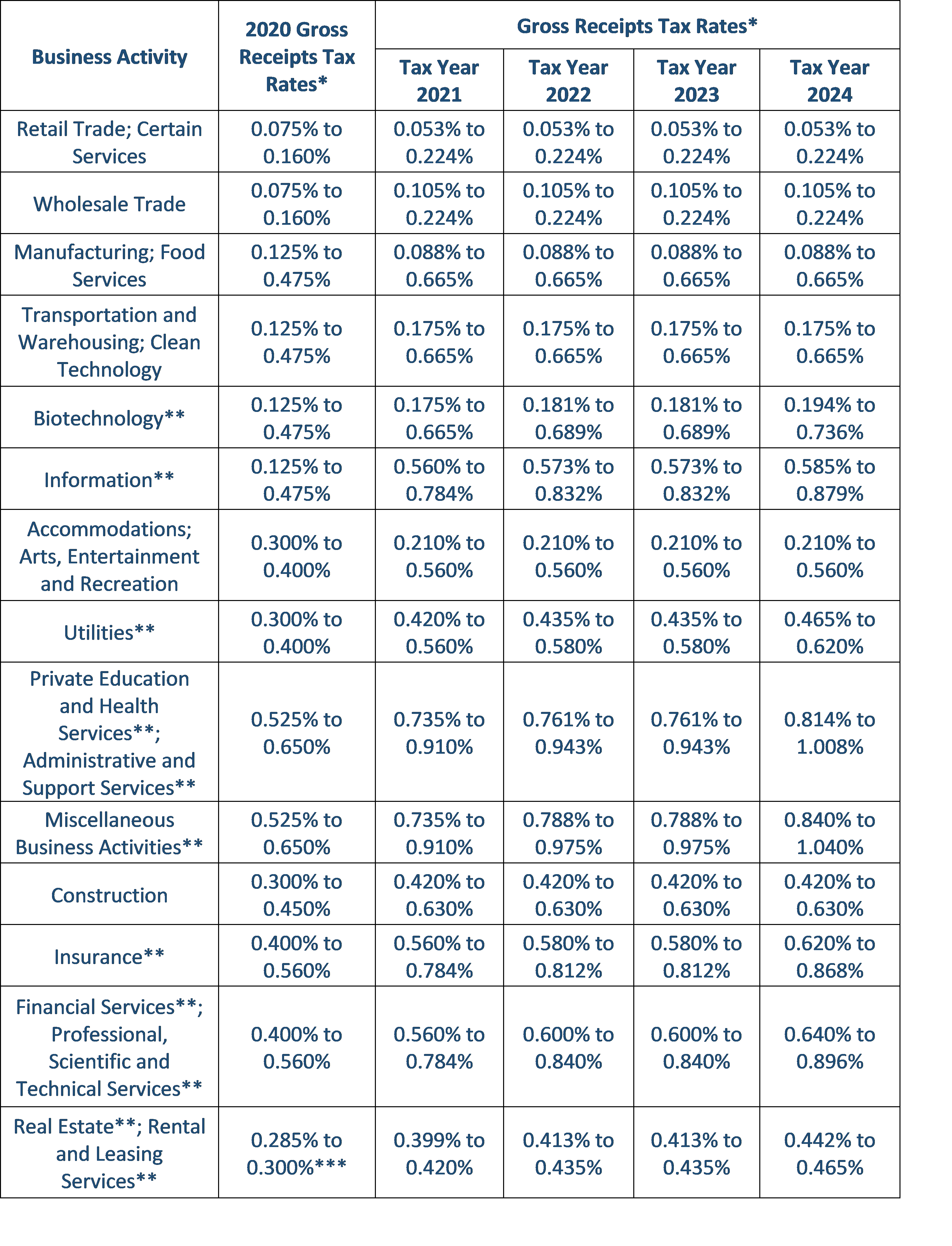

Gross Receipts Tax (GR) Treasurer & Tax Collector, A corporation or partnership, other than a tax shelter, that meets the gross receipts test can generally use the cash method. For taxable years beginning in 2025, a corporation or partnership meets the gross receipts test of § 448(c) for any taxable year if the average annual gross receipts.

2025 NBPPC 2025 National Bridge Preservation Partnership Conference, A corporation or a partnership. For taxable years beginning in 2025, a corporation or partnership meets the gross receipts test of § 448(c) for any taxable year if the average annual gross receipts.

Determine ERC Gross Receipts Test 2025 Quickly For 2025, Accounting methods, inventory rules, and some other rules depend on meeting a “gross receipts test.” meet it and you can use the simple options. By nick uren, j.d., mba, aldrich cpas + advisors, lake oswego, ore.

Buy 2025 Diary 2025 Diary A5 Page a Day from Jan. 2025 to Dce.2025, These faqs provide an overview of the aggregation rules that apply for purposes of the gross receipts test under internal revenue code (code) section 448 (c) (section 448 (c). The irs issued a safe harbor that allows an employer to exclude certain amounts received from other coronavirus economic relief programs in determining whether it qualifies for the employee retention credit (erc) based on a decline in gross receipts (rev.

What Are Gross Receipts? Definition, Uses, & More, Accounting methods, inventory rules, and some other rules depend on meeting a “gross receipts test.” meet it and you can use the simple options. For 2025, you begin qualifying in the quarter when your gross receipts are less than 50% of the gross.

Gross Receipts Tax (GR) Treasurer & Tax Collector, In the gross receipts test you compare the gross receipts of quarters 2, 3, and 4 of 2025 to the gross receipts of the same quarters in 2019. For taxable years beginning in 2025, a corporation or partnership meets the gross receipts test of § 448(c) for any taxable year if the average annual gross receipts.

My Target receipt came out to exactly 50.00 after tax r, By nick uren, j.d., mba, aldrich cpas + advisors, lake oswego, ore. Tax relief for working families.

What a Contractor Should Know About the Gross Receipts Test Grassi, This test is met if a taxpayer has average annual gross receipts for the three prior taxable years of $25 million or less (adjusted for inflation). Foreign corporations, controlled groups, and the gross receipts test.

Buy 2025 Vertical 11×17 2025 Wall Runs Until June 2025 Easy, The irs ruled in letter ruling 202140002 (released oct. Accounting methods, inventory rules, and some other rules depend on meeting a “gross receipts test.” meet it and you can use the simple options.

The erc was terminated for most employers as of september 30, 2025, but the law currently allows employers until april 15, 2025 to file refund claims for 2025.